Overview

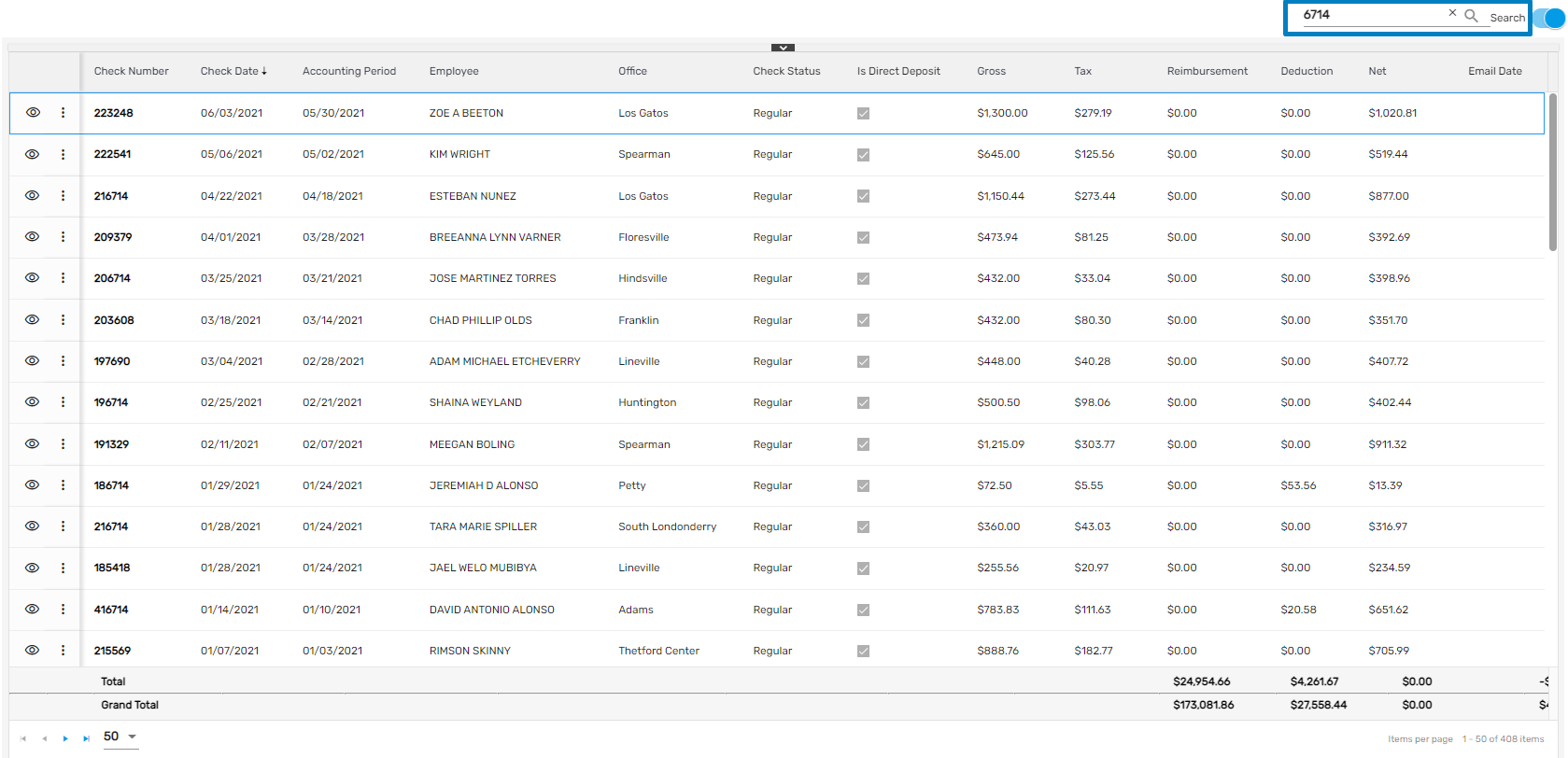

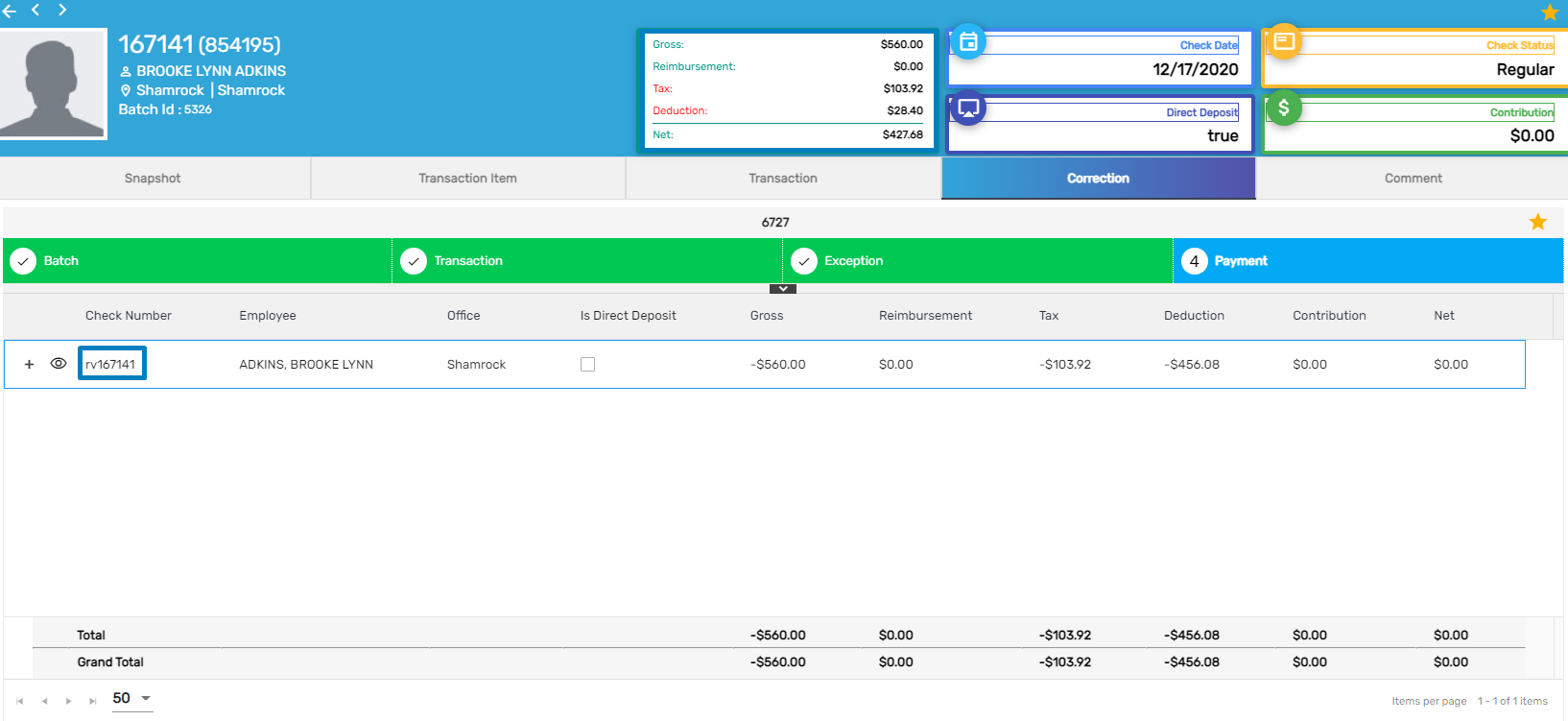

The payment summary page displays the 'Check Number,' 'Check Date,' 'Accounting Period,' 'Employee,' 'Office,' etc. After the transactions are posted and the checks are issued, these details can be viewed in the payment navigation. In this section, users can make corrections for the transactions which are already posted.

Users can search the payment based on 'Check Number,' 'Check Date,' 'Accounting Period,' 'Batch Id,' 'Office Name,' and 'Employee.'

Users can be redirected to payment and employee navigation from the eye view icon.

Payment

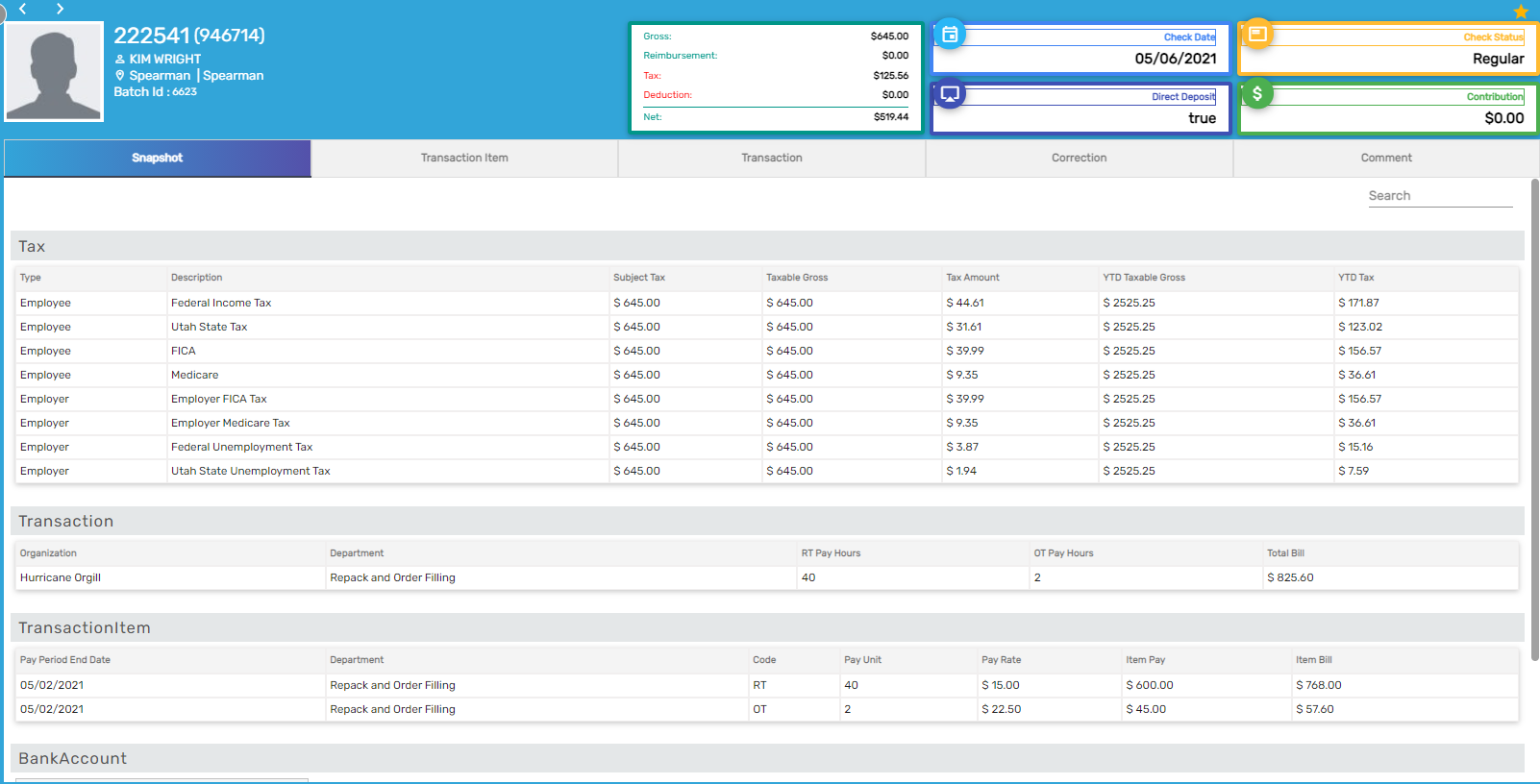

From this main navigation, users can view the 'Snapshot,' 'Transaction Item,' 'Transaction,' 'Comment,' and do the payment 'Correction.'

Payment Correction

Payment corrections are processed under different scenarios. If there is some problem with the employee’s check then the issue can be corrected by voiding, reissuing, and reversing that specific check. The process for correction is:

- Go to Payment main navigation

- Search the required payment

- Go to the detail of the payment and move to the 'Correction' top navigation

- Create a 'Batch'

- Select the required batch type

- Move to the 'Transaction' (transaction can be edited based on selected batch)

- Move to 'Exception'

- Move to 'Payment'

Our system provides different ways of correcting the Payment. They are as follows,

- Reissue

- Reverse

- Reverse and Reissue

- Reverse and Reissue with Invoice Correction

- Void

- Void and Invoice Correction

- Void and Reissue

- Void and Reissue with Invoice Correction

Reissue

If an issued check wasn’t deposited due to multiple reasons like lost or lapsed the due date or damage then it should be reissued. After the check has been reissued, the check number is different than that of the original check. The user should select the current A/P, check date, and bank information.

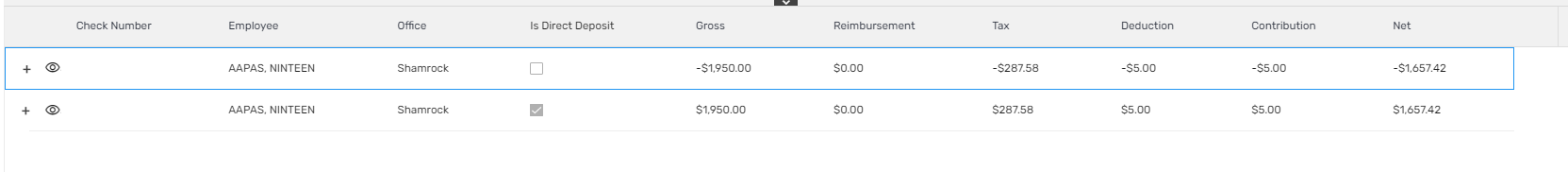

Users need to select batch type as a 'Reissue' for the correction. Another check is created to balance out the payment. Payment is shown as,

Payment Batch report is generated.

Reverse

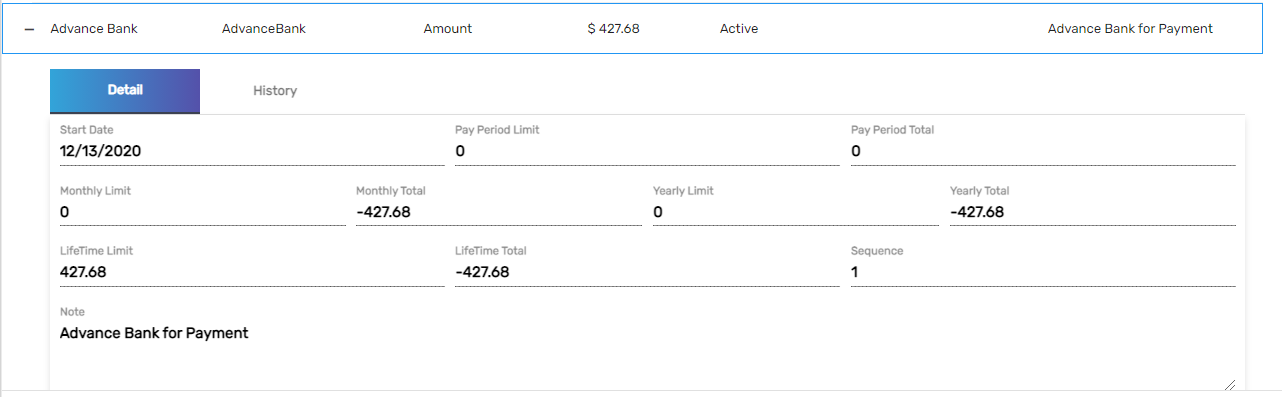

'Reverse' action is done when the check is mistakenly given to the third person or there is some issue with the amount but the employee has already cashed out the check. When the check is reversed the net amount of the check is added as total to 'Advance Bank' in the employee’s pay setup.

Users can view the detail of the original check at the top of the screen in a tile. While reversing the check, it will create an advance bank for the employee and it will be reversed.

After posting the correction, it will create ‘Advance Bank’ for the employee. Users can view the payroll batch report. Click on the eye view icon, and be redirected to the employee payroll tab.

After posting the correction, it will create ‘Advance Bank’ for the employee. Users can view the payroll batch report. Click on the eye view icon, and be redirected to the employee payroll tab.

Go to the deduction navigation, you can see the net amount in the 'Advance Bank' that the employee should receive.

Reverse and Reissue

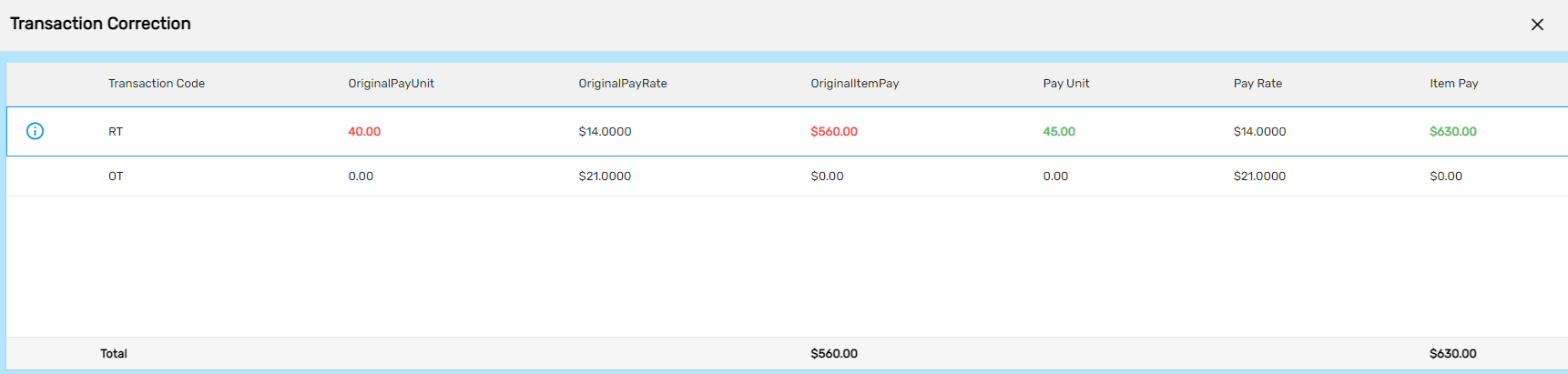

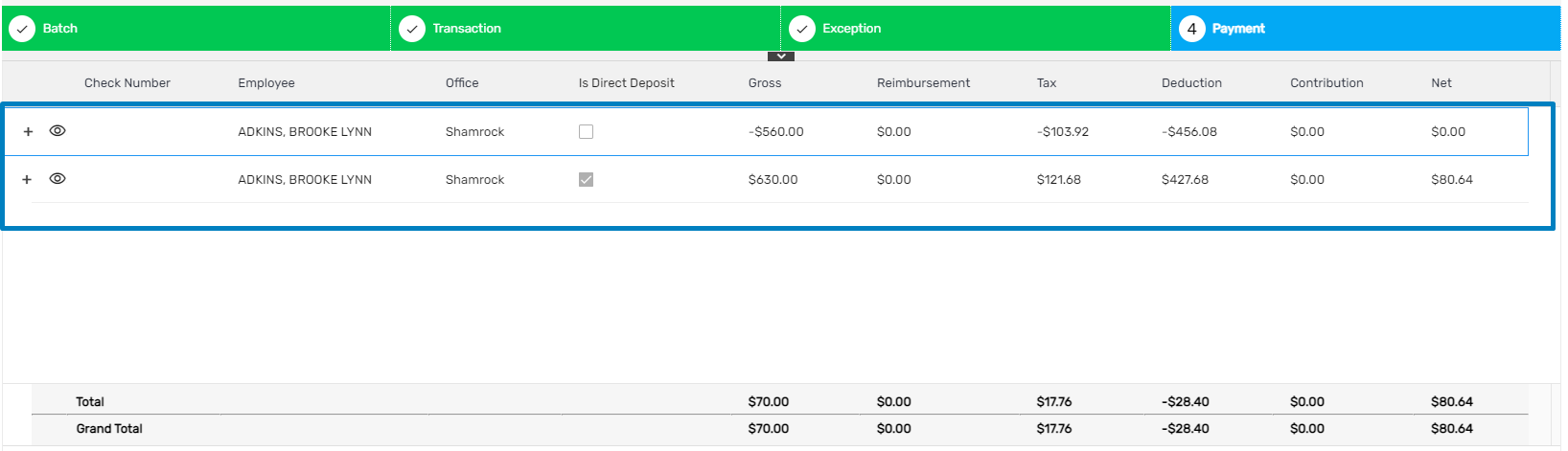

After handing over the check to the employees, if there is some mistake with the check amount then 'Reverse and Reissue' is done. The check amount will be adjusted and corrected and a new check will be issued.

Using this action, we can edit the transaction amount. We can update the pay unit/amount.

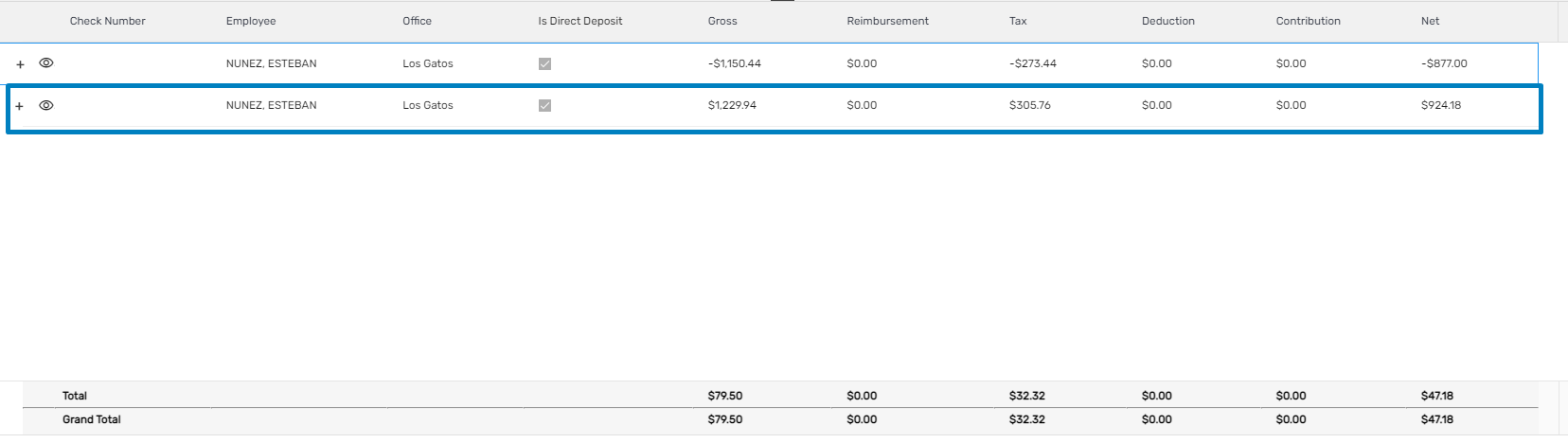

If the employee has received more amount than the actual amount, then the amount goes to the 'Advance Bank'. Users can see the two checks in the payment, where the first one if voiding and the second is a regular check.

Users will receive a check based on the net amount.

Reverse and Reissue with Invoice Correction

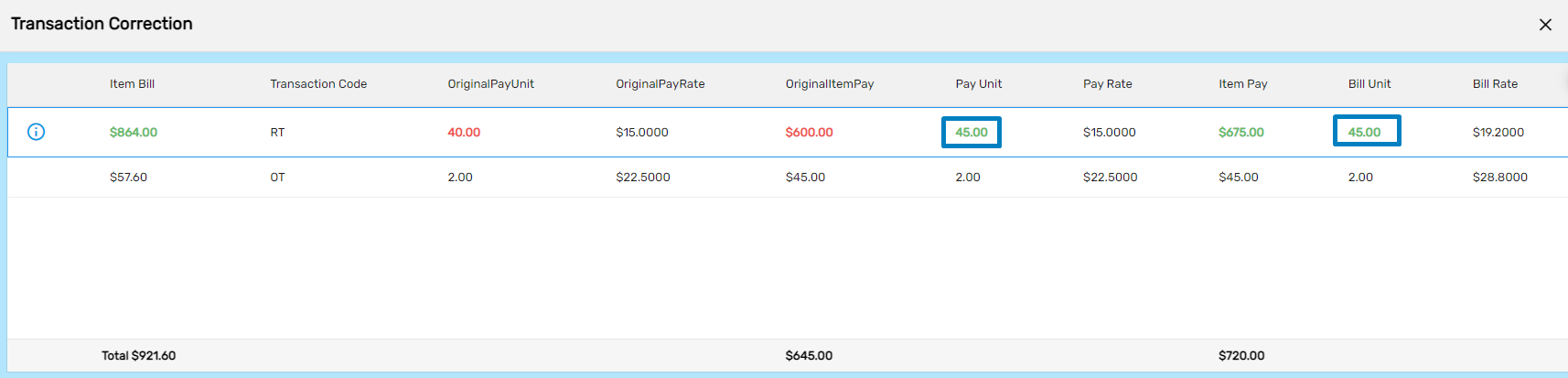

This is similar to 'Reverse and Reissue' and it is correct invoices that are billed to the customer. While editing the transaction pay unit, users can update the billing unit as well. With reverse and reissue correction, a check is reversed and reissued and users can correct the invoice part by editing the transaction.

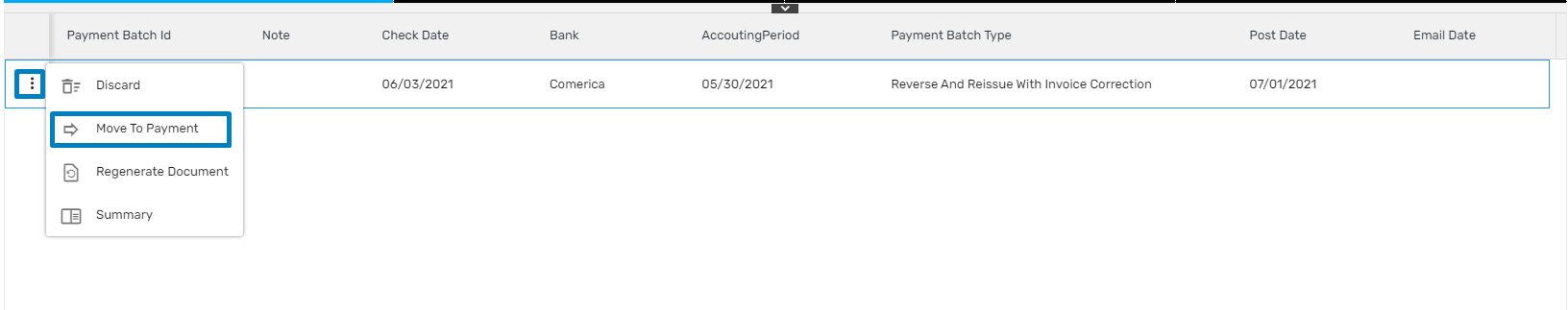

As both the pay and bill unit is updated, print and post the batch. Users can view the posted batch. Click on the vertical ellipsis icon and click on move to payment.

Users can view the original and reversed payment. Click on the eye view icon of the original payment and go to the History tab.

Users can view the original and reversed payment. Click on the eye view icon of the original payment and go to the History tab.

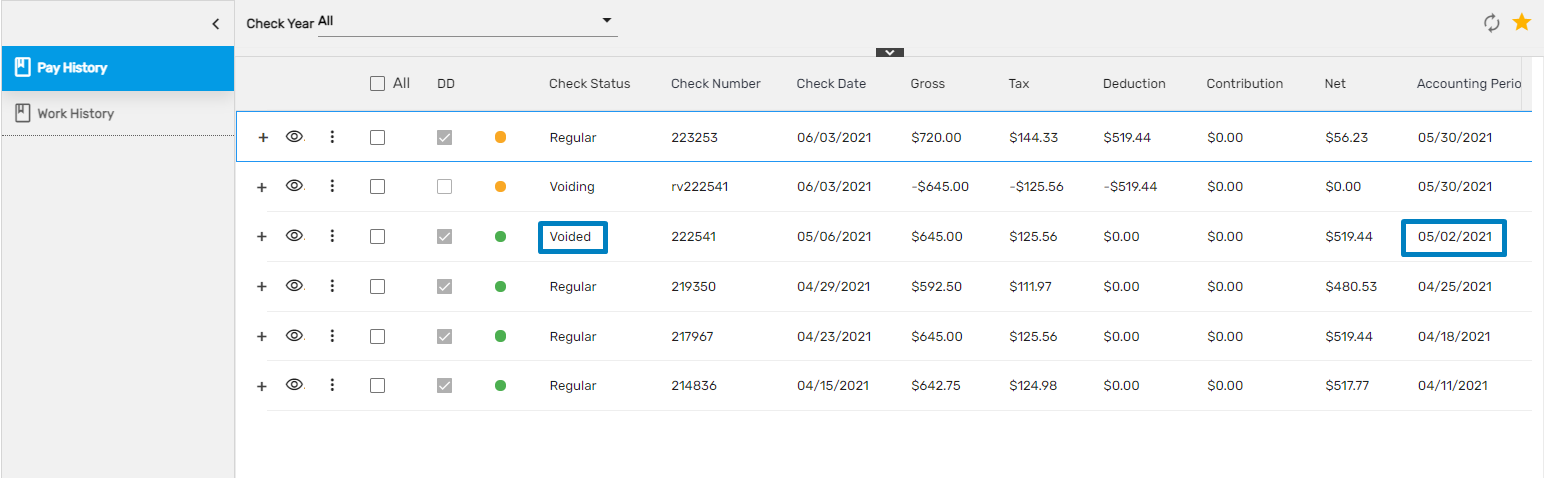

In the pay history navigation, users can view the voided, voiding, and regular payment. Take a look at the accounting period of the voided payment and move to work history navigation.

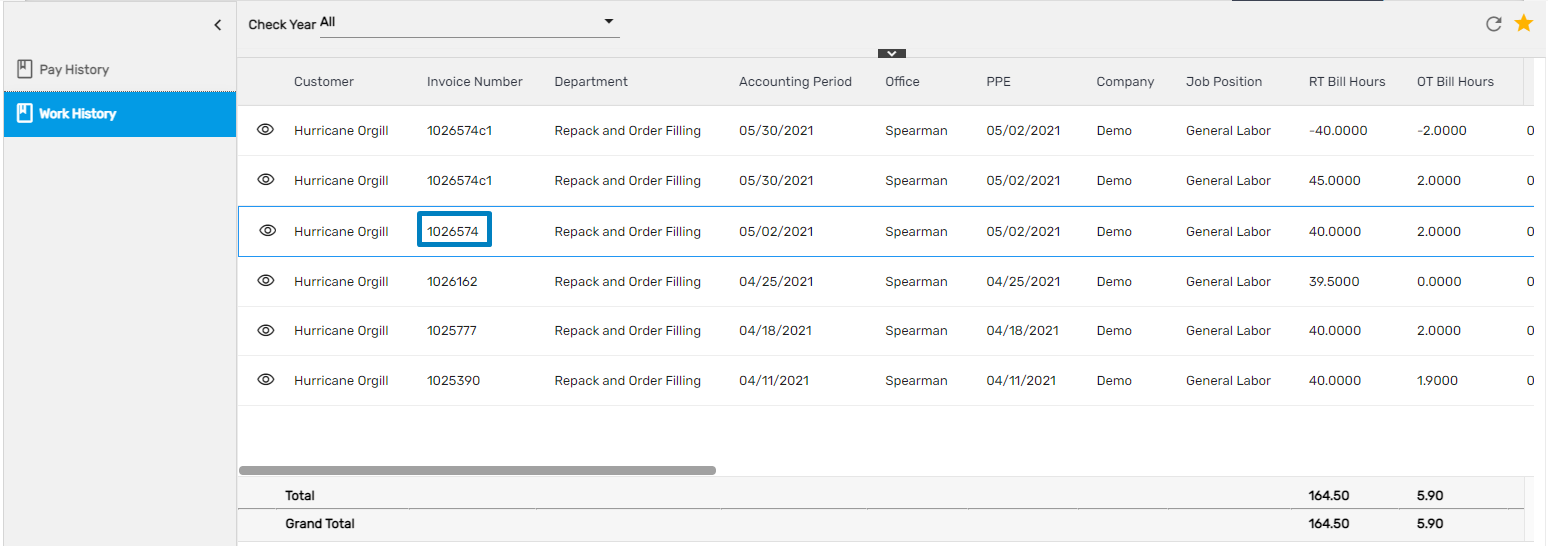

In the work history navigation, copy the original invoice number having the same accounting period and go to the IMS application and click on invoice navigation.

In the work history navigation, copy the original invoice number having the same accounting period and go to the IMS application and click on invoice navigation.

Search the copied invoice number.

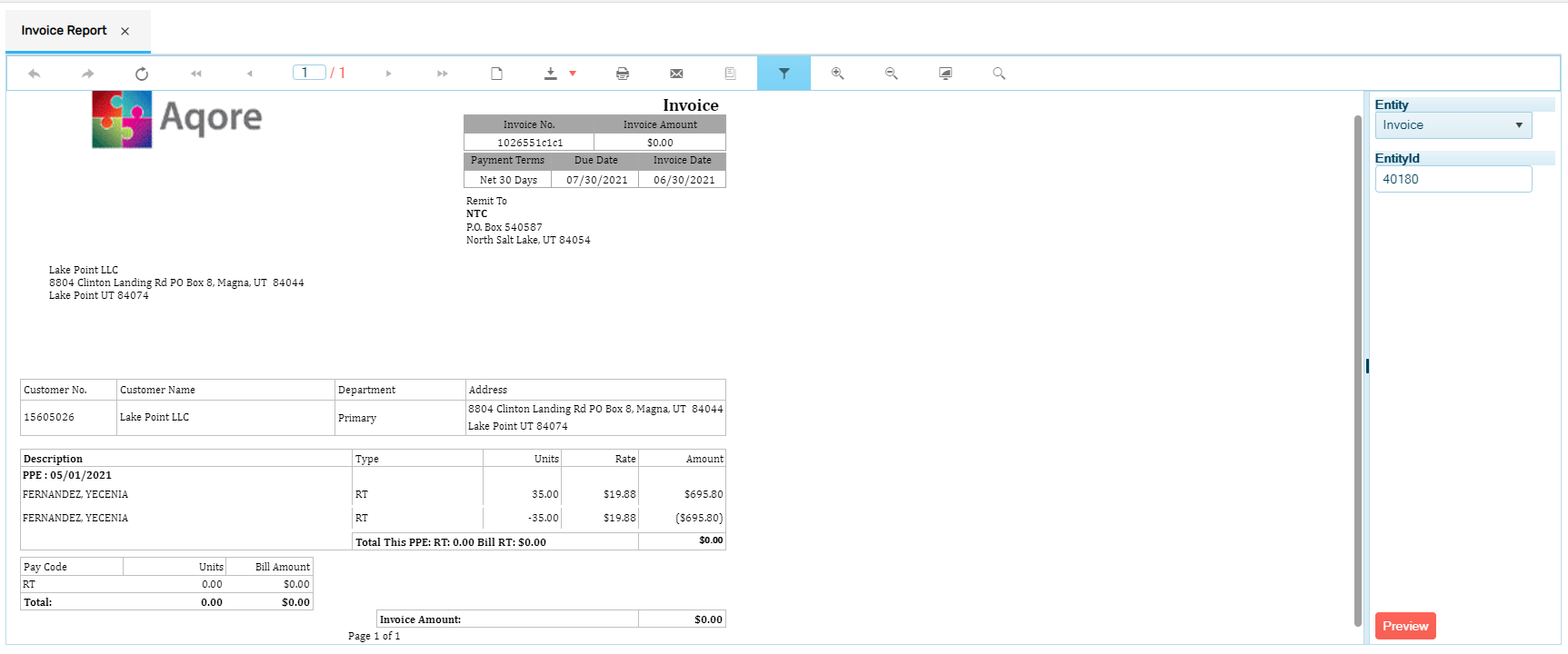

Users can view the corrected and original invoice numbers. Click on the original invoice and go to the correction tab. Users can view the invoice correction of the respective payment batch.

Users can view the corrected and original invoice numbers. Click on the original invoice and go to the correction tab. Users can view the invoice correction of the respective payment batch.

Void

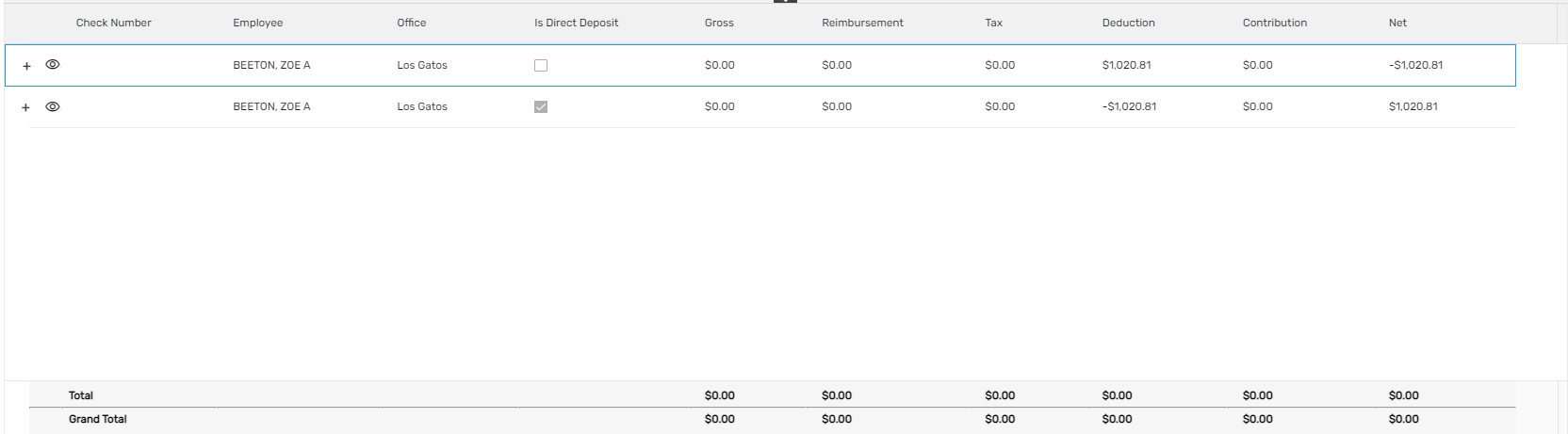

If the check has been mistakenly issued for an employee whom it should not have been, then the check should be voided. Once the payment is voided, it creates a negative transaction.

Void and Invoice Correction

This is similar to void. With void and invoice correction, a check is voided and users need to correct the invoice part by editing the transaction.

When the existing payment needs to be voided and a new invoice is created, then the void and invoice correction option is used.

Precondition: Invoice should be posted for the respective employee's customer.

Some of the cases,

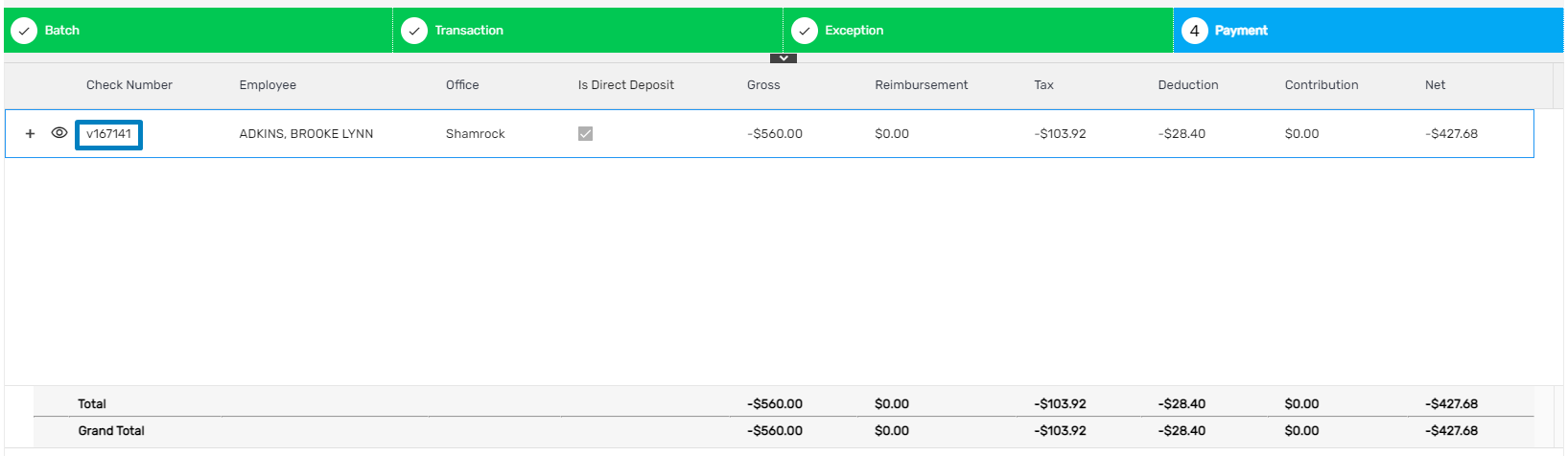

- On the payment tab, check with v+ original check number is created. All the transactions will be negative i.e., Gross, Tax, Deduction, and net amount. Transaction will be voided.

- Original check status should be voided and the status of the new check should be voiding

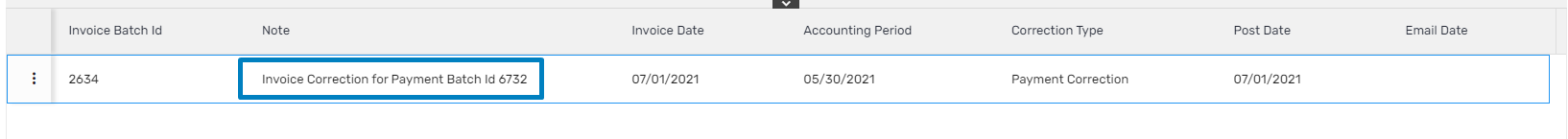

- From the invoice directory on IMS: A new batch transaction correction is created on the Correction tab with the note: Invoice Correction for Payment Batch Id xxxxxx

- Modified bill unit/bill rate for each transaction item should be reflected on the Transaction item tab and transaction tab and in the invoice merge report as well.

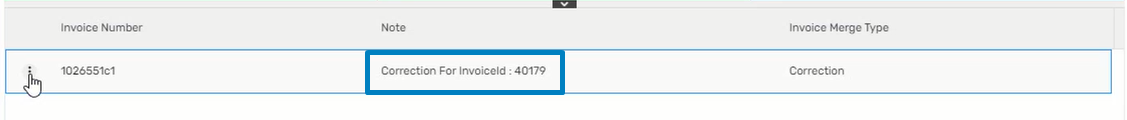

- A new invoice number with the original invoice number +C1 should be created with the corrected transaction amount i.e., zero.

After the payment is posted, a check is voided and the invoice is updated accordingly. On the invoice, the side payment is automatically voided and corrected.

Users can view the invoice merge report by clicking on vertical ellipsis and generate a report.

Void and Reissue

If there is any mistake in the issued check then-current check needs to be void and a new check needs to be reissued. If the check hasn’t been cashed out then the user needs to void and reissue the check.

Here are some cases,

- Users can edit the transaction, and the net amount is calculated accordingly.

- An advance bank is not created.

- Transaction will be voided i.e. ‘Gross’, ‘Deduction’, ‘Tax’, and ‘Net’ amount will be zero.

- Likewise, after the payment is posted, users can generate paycheck reports.

- Void and reissue with invoice correction

The process is similar to void and reissue. With void and reissue with invoice correction, a check is voided and reissued, and users need to correct the invoice part by editing the transaction. It will create a new invoice with corrections.

Here are some cases,

- Transaction items can be corrected for Pay unit, Pay rate, Bill unit, and Bill rate.

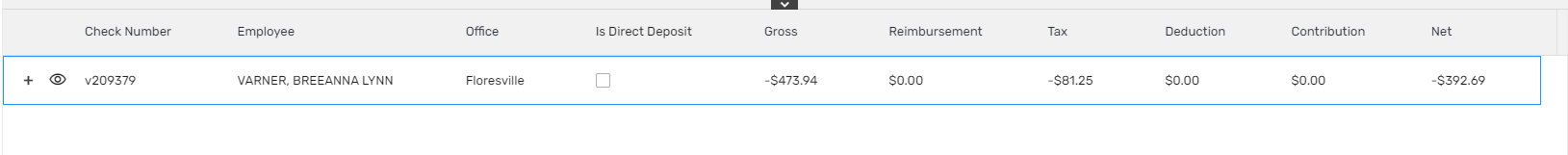

- On the payment tab, two checks are created. One with the v+ original check number where all the transactions will be negative i.e., the transaction will be voided. Another one with the new check number where the updated/corrected transaction is reflected.

- Original check status after posting the correction payment batch will be voided. The status of the v+ original check number will be voiding and the newly created check will be regular.

- From the invoice directory on IMS: A new batch type payment correction is created on the Correction tab with the note: Invoice Correction for Payment Batch Id xxxxxx

- Modified bill unit/bill rate for each transaction item should be reflected on the Transaction item tab and transaction tab and in the invoice merge report as well.

- A new invoice number with the original invoice number +C1 should be created with the corrected transaction amount i.e., original amount- modified amount.