Overview

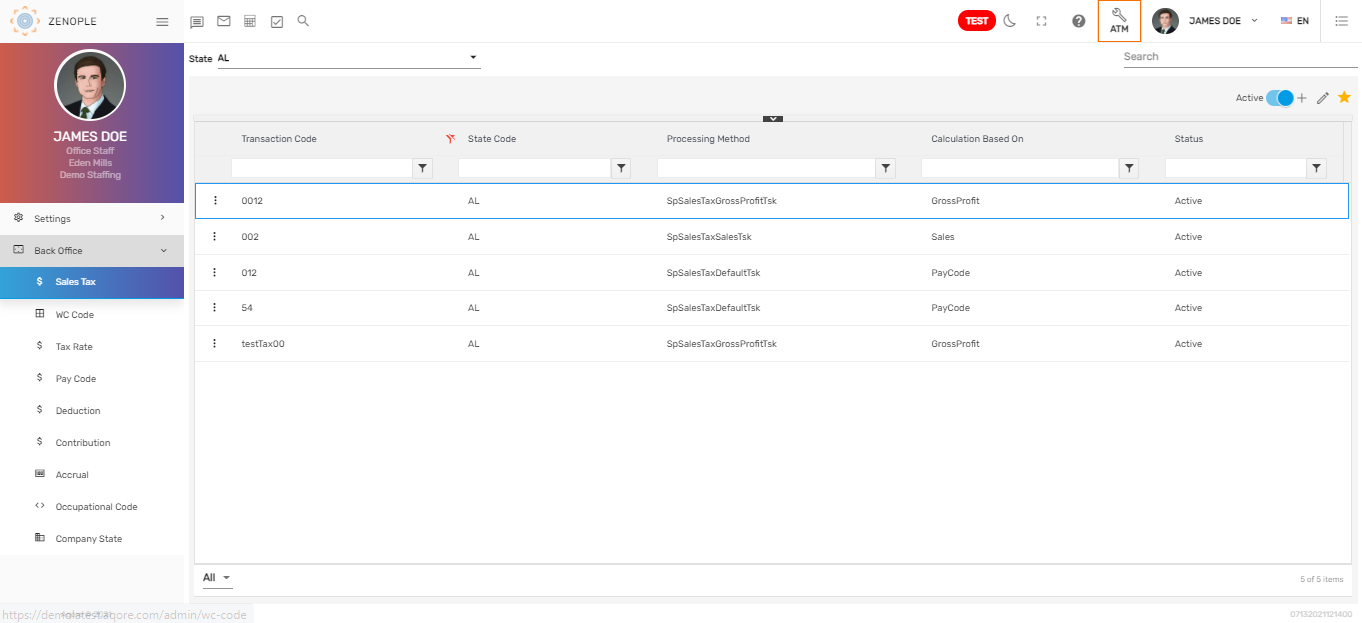

‘Sales Tax’ main navigation consists of a list of sales tax records in the directory under various states. It allows users to add and edit multiple sales tax details such as calculation base for sales tax, state, processing method, descriptions, sales tax’s rate with start and end date. Also, users can manage access to this sales tax as required. Sales Tax is mainly used in Invoice Management System (IMS) for invoicing.

Users can enable or disable the ‘Active’ toggle button to view active or inactive sales tax as required. Users can also search for the sales tax from the search box or use the filter for the directory’s sales tax records. By default, Active sales tax are displayed.

Users can choose the state from the dropdown to view the sales taxes added under the selected state.

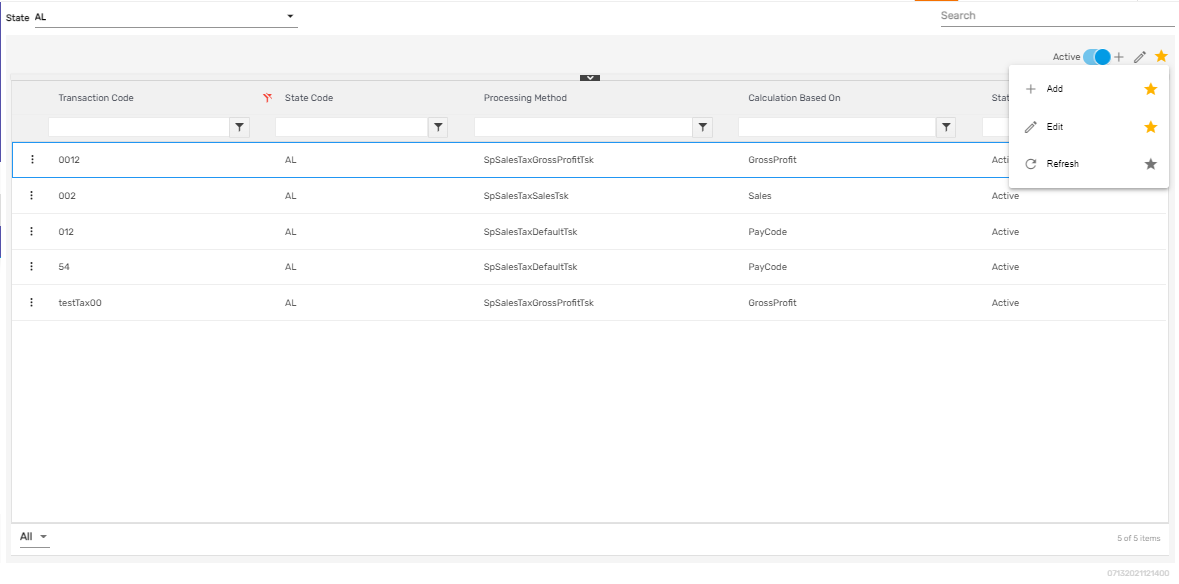

Favorite Action

There are three actions in the favorite icon of the 'Sales Tax' directory. They are:

- Add

- Edit

- Refresh

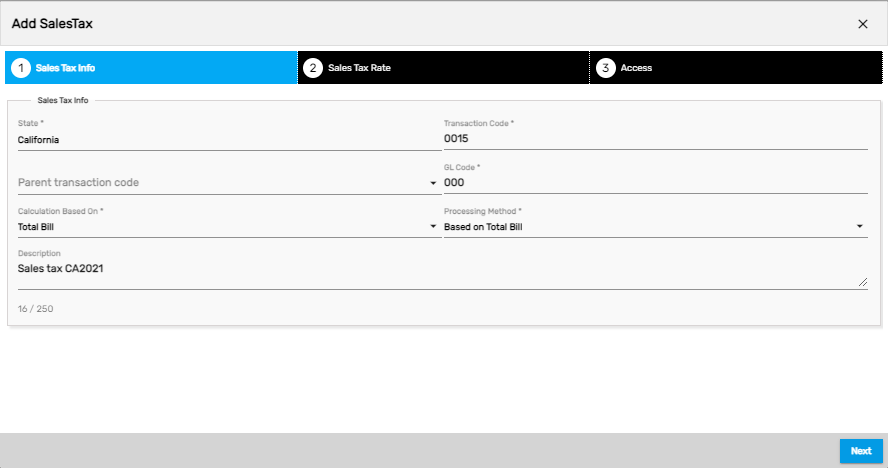

Add

It allows users to set up the sales tax details including its transaction code, calculation base, status, state code for the sales tax, effective start date and end date, and sales tax rate. Users must select the state from the dropdown to add a sales tax under a specific state. There are three steps to add a sales tax. They are:

- Sales Tax Info

- Sales Tax Rate

- Access

1. Sales Tax Info

Users need to enter sales tax info such as 'Transaction Code,' 'GL Code,' 'Calculation Base,' 'Processing Method,' and 'Description.'

There are various calculation bases for the sales tax in Zenople such as 'Gross Profit,' 'Sales,' 'Total Bill,' etc. They are customizable as per the company’s requirements.

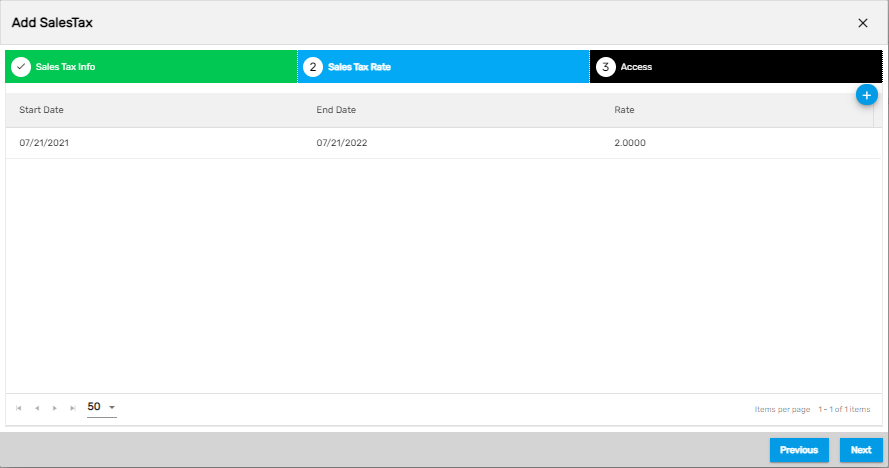

2. Sales Tax Rate

In this stage, users need to add a start date and end date for the sales tax to be active to use the sales tax rate. Users should be careful about overlapping dates for the sales tax.

3. Access

In this step, users can control their access to this sales tax rate. Only companies and offices having access to this sales tax will be able to use this sales tax.

.png)

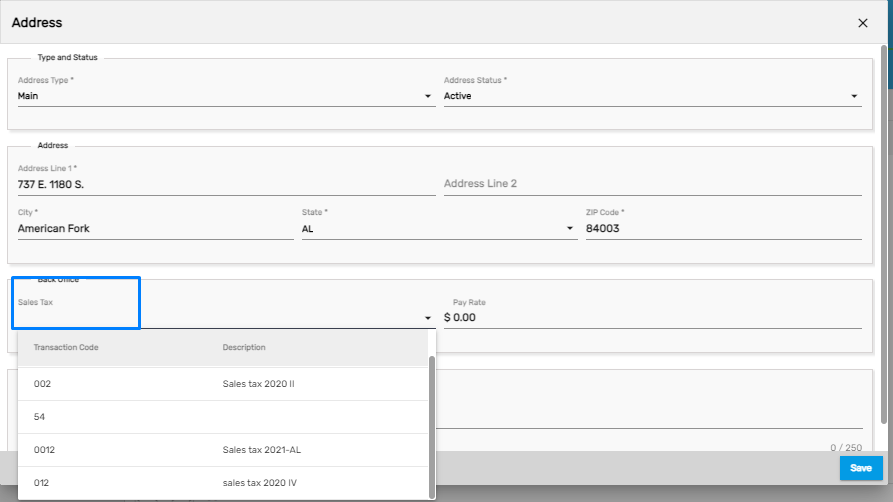

The sales tax added from ATM will be displayed as an option while adding/editing 'Address' in Lead Tracking System (LTS)/ Sales Pipeline Management (SPM)/ New Customer Onboarding (NCO)/ Customer Management System (CMS) application in ‘Sales Tax Field’ under a particular state.

Edit

It allows users to edit the sales tax details as required.

Refresh

It allows users to refresh the sales tax details in case any changes are not reflected.

There are two actions under the vertical ellipsis button of the sales tax directory. They are:

- Access

- Inactive

.png)

1. Access

It allows users to manage the access of the sales tax similar to adding or editing a sales tax.

2. Inactive

Users can disable a sales tax and change its status to ‘Inactive’ from this action. When the specific sales tax is disabled, it cannot be used by the user.