Overview

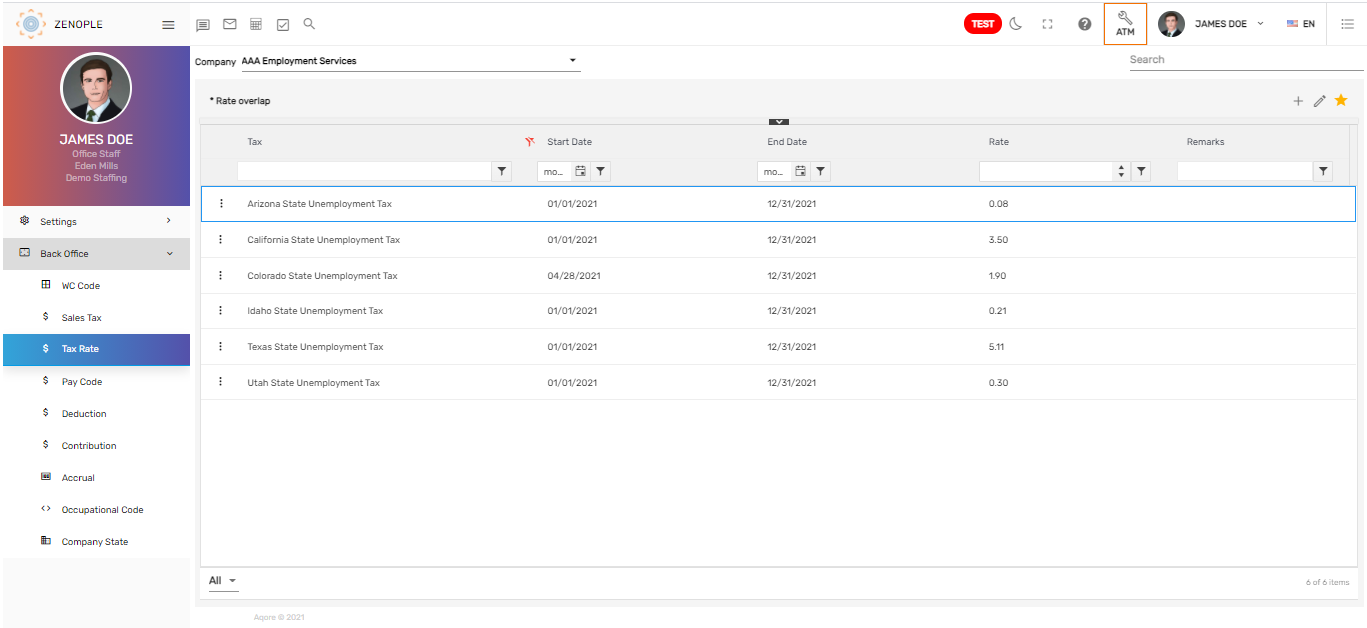

'Tax Rate’ main navigation consists of a list of SUTA tax rate records in the directory for a specific company. It allows users to add and edit multiple SUTA tax rate details in specific states along with details such as tax name, start and end date for tax imposing, and the tax rate. Also, users can manage access to this tax rate as required. The tax rate is imposed on employees and employers and it is also used in the payroll process.

Users can also search for the tax rate from the search box or use the filter for the directory’s tax rate records. By default, Active tax rates are displayed.

Users can choose the state and entity from the dropdown to view the tax rate added under the selected state.

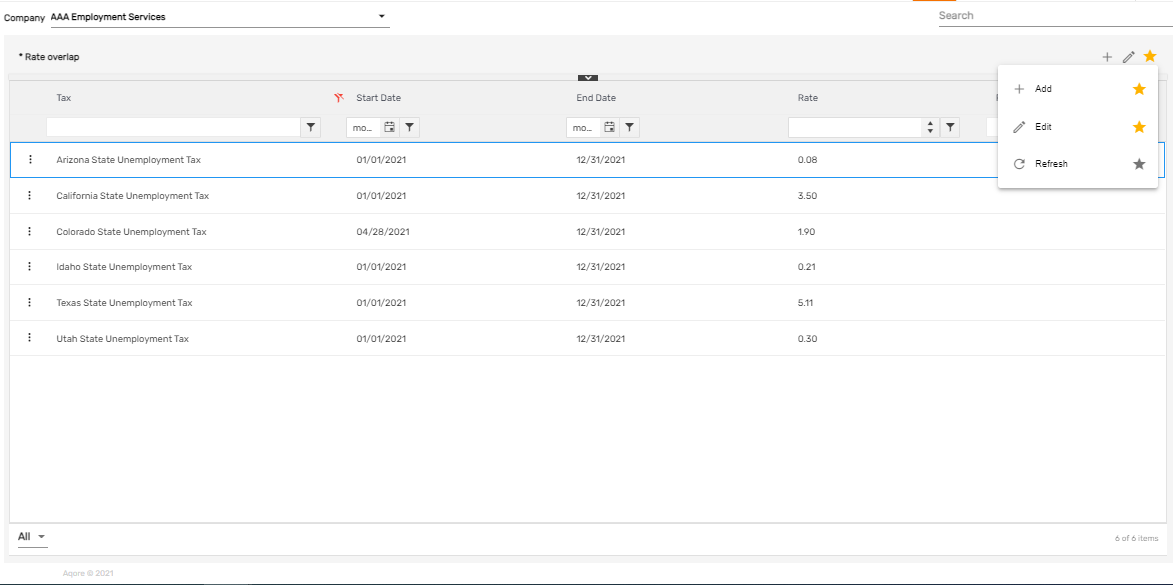

Favorite Action

There are three actions in the favorite icon of the 'Tax Rate' directory. They are:

- Add

- Edit

- Refresh

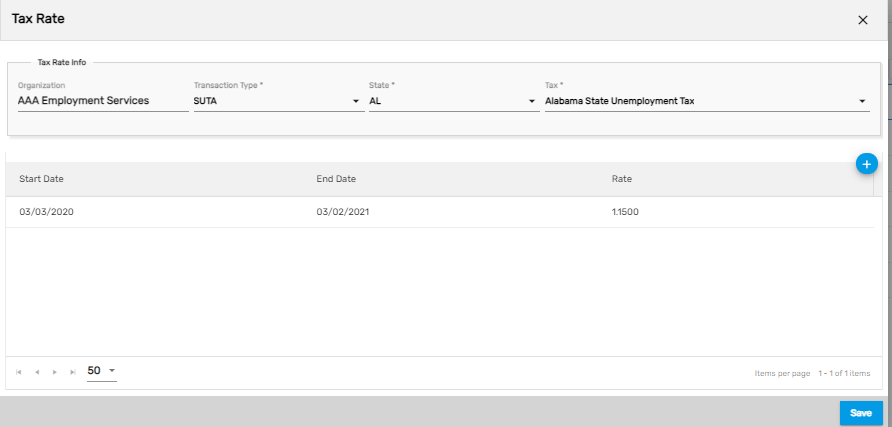

Add

It allows users to set up the SUTA tax rate under various states with the effective start date and end date. As multiple tax rates can be added, the end date of the old tax rate and the start date of the new tax rate cannot be overlapped. Users must select the company from the dropdown to add a tax rate under a specific company.

Edit

It allows users to edit the tax rate details as required.

Refresh

It allows users to refresh the tax rate details if changes are not reflected.

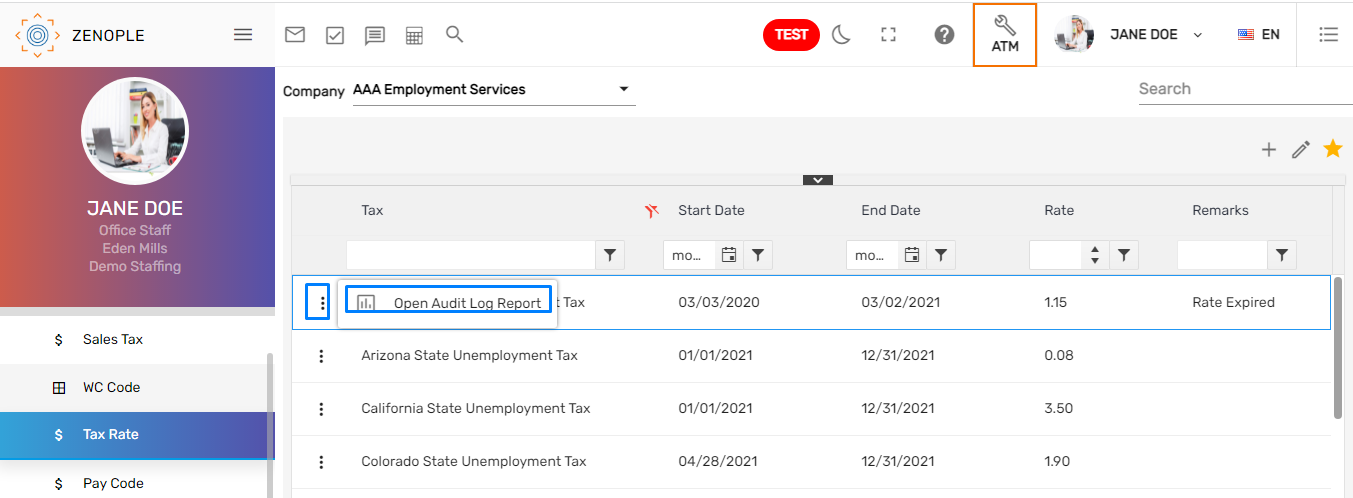

There is a single action ’Open Audit Log Report’ in the vertical ellipsis button of the tax rate directory. The action allows users to view the 'Audit Log Report' that displays the tax rate modified history with updated values, date, and the user who updated it with previous values of the tax rate.

.png)