SSN/ITIN Feature Description:

This feature involves making changes to the system to accommodate SSN/ITIN updates and validation rules. Specifically, it involves updating the label for SSN to "SSN/ITIN" and implementing validation rules to address SSN starting with "9" as well as recognizing valid ITIN.

Individual Taxpayer Identification Number

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the Internal Revenue Service (IRS) in the United States. It is used for tax purposes by individuals who are required to file U.S. tax returns but are not eligible for a Social Security Number (SSN), which is typically issued to U.S. citizens and certain eligible noncitizens.

Basic ITIN Format Validation:

Format: An ITIN should have the following format: 9XX-8X-XXXX. Here's what each part represents:

- The first digit is always "9."

- The second and third digits (XX) can be any number.

- The fourth and fifth digits (8X) should fall within specific ranges: 50 to 65, 70 to 88, 90 to 92, and 94 to 99.

- The last four digits (XXXX) can be any number, with no specific restrictions.

Length: The ITIN should consist of exactly nine digits, including hyphens.

Hyphen Placement: The hyphens should be correctly placed in the format as shown (e.g., 9XX-8X-XXXX).

Updated Areas:

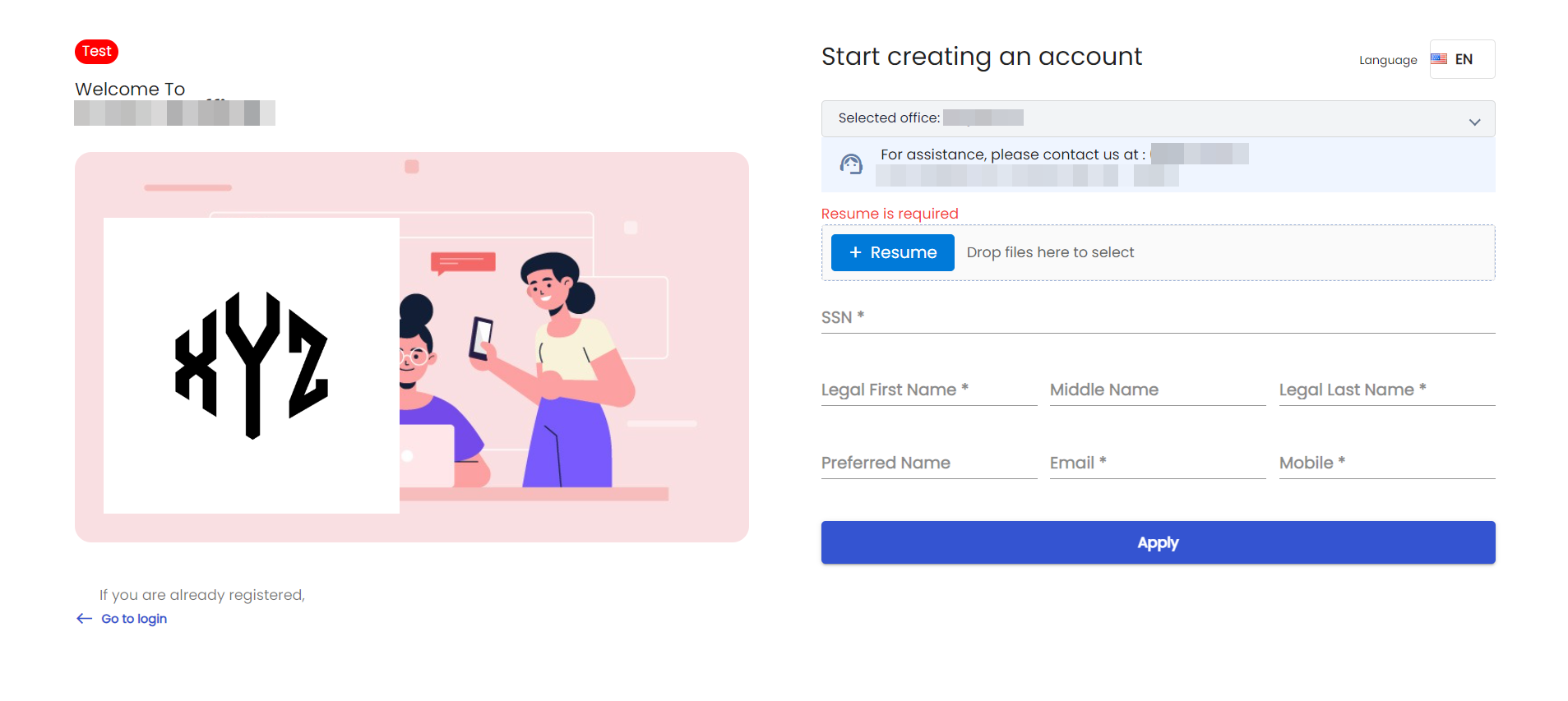

Registration Page

Applicants now see the new field SSN/ITIN while creating the account on the Registration Page. This enhancement in the registration process reflects our commitment to accommodating the unique needs and circumstances of our users.

This field has been designed to accept either an SSN or an ITIN number, offering flexibility to users.

To ensure accuracy and compliance, it's essential to input a valid SSN or ITIN number. For those entering an ITIN number, it must adhere to the validation rules outlined above; otherwise, the system will promptly detect any discrepancies and display an error message to guide users in rectifying their input. This diligent validation process ensures that only accurate and compliant tax identification numbers are accepted.

Additionally, it's crucial to note that the information entered in this field should be unique. If the system detects any duplicate entries or information that already exists in the database, it will trigger an error message to prevent redundancy and maintain data integrity. This feature ensures that each SSN or ITIN entered remains distinct within the system, promoting efficient record-keeping and accuracy.

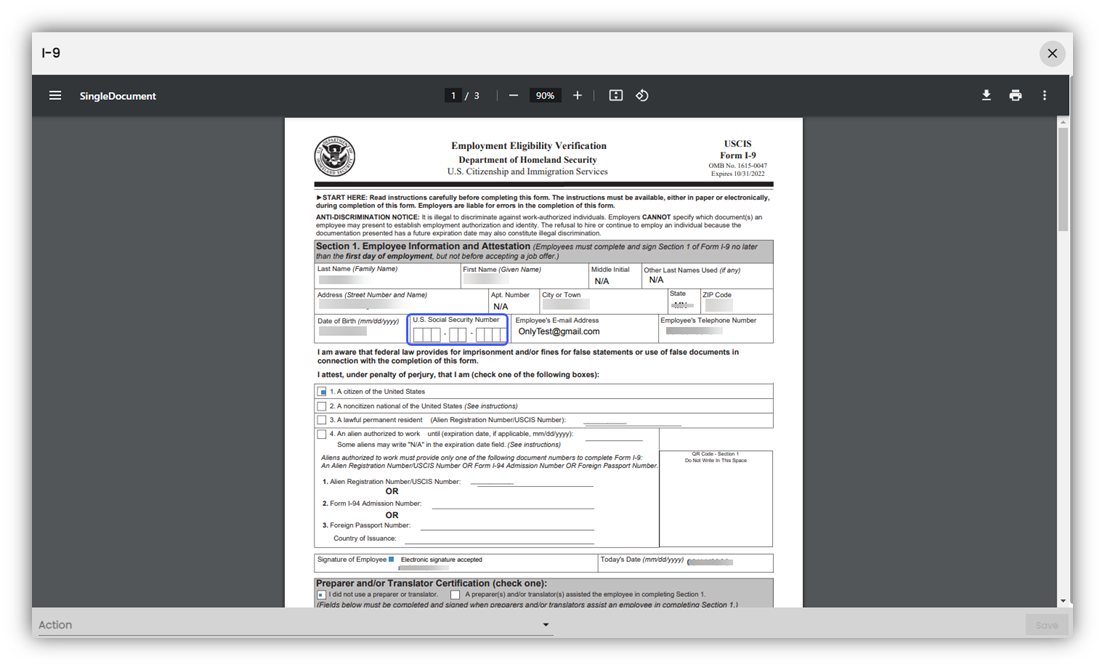

I-9 and E-Verify Forms

When applicants enter their ITIN number instead of their SSN, the system now intelligently leaves the SSN field blank in the I-9 Form. This improvement ensures that the form accurately reflects the tax identification information provided by the user, avoiding any confusion or discrepancies.

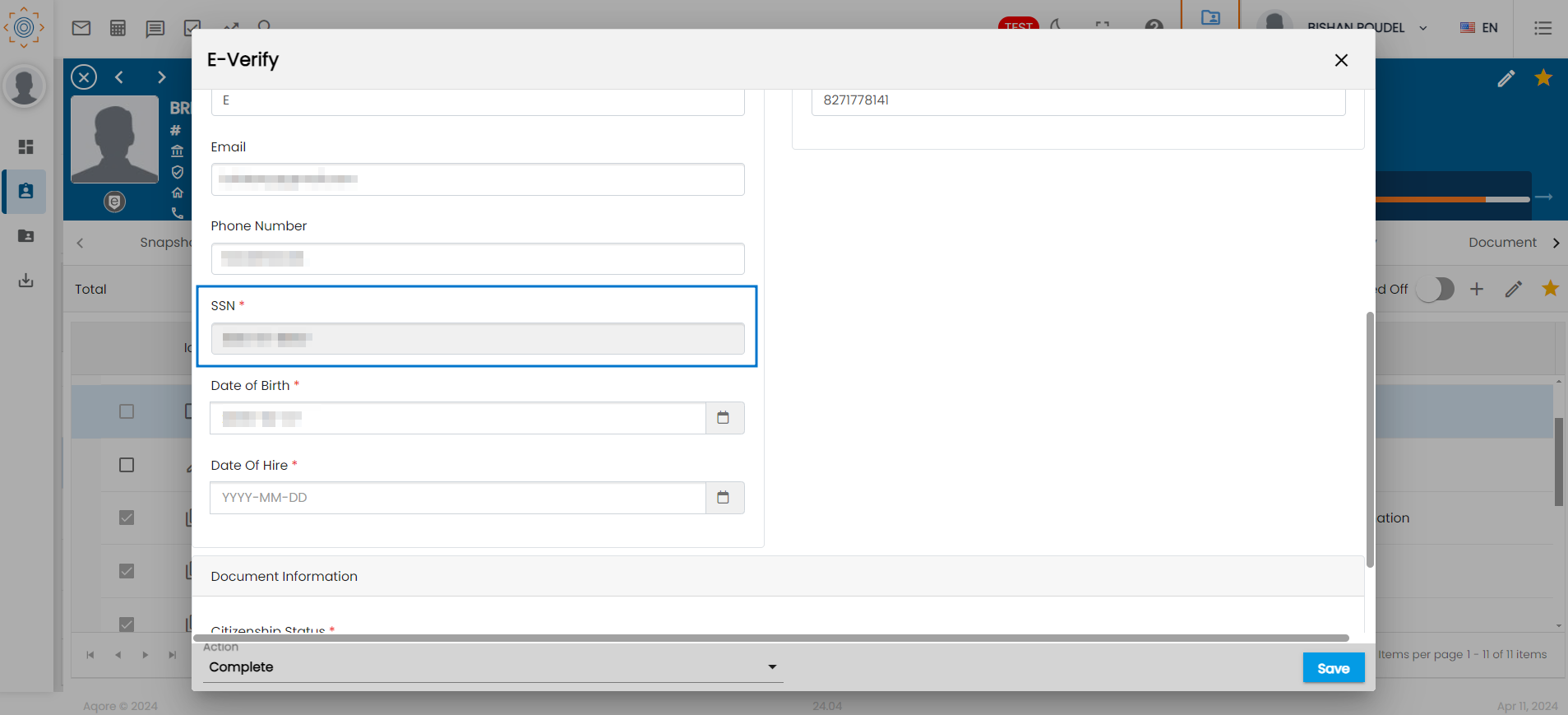

When applicants enter their ITIN number instead of their SSN, the system now intelligently leaves the SSN field blank in E-Verify form as well. This improvement ensures that the form accurately reflects the tax identification information provided by the user, avoiding any confusion or discrepancies.

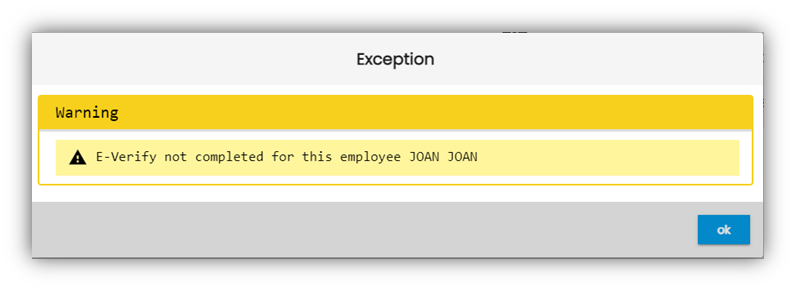

When the E-Verify is incomplete, Severe exception used to be displayed on assigning Assignments to the employees.

But now it has been changed to normal warning exception only.

Steps to follow if the applicant request to update ITIN to SSN.

Archiving and Re-assignment:

- When an applicant requests to update ITIN to SSN, the office staff will take the necessary action.

- They will archive the existing forms (I-9 and Personal Information) associated with the applicant's profile.

- Then, the forms will be reassigned to the applicant for updates.

Applicant's SSN Entry:

- The applicant will fill in the SSN information in the Personal Information form.

- After entering the SSN, they can proceed to complete the Personal Information form.

Autofill in I-9 Form:

- Once the Personal Information form is completed with the SSN; the system will automatically populate the SSN/ITIN field in the I-9 form with the added SSN value.

- The applicant can then move ahead to complete and submit the I-9 form.

I-9 Review

- The recruiter will review the updated I-9 form, which now contains the SSN.

E-Verify eligible

- The recruiter can proceed to submit the E-Verify form, ensuring compliance with the mandatory SSN requirement for the E-Verification process.