Aqore will do the necessary setup of your Organization on Greenshades and will also create an account for you.

Moreover, you will receive a similar email for the account setup. Follow the instruction and set up an account.

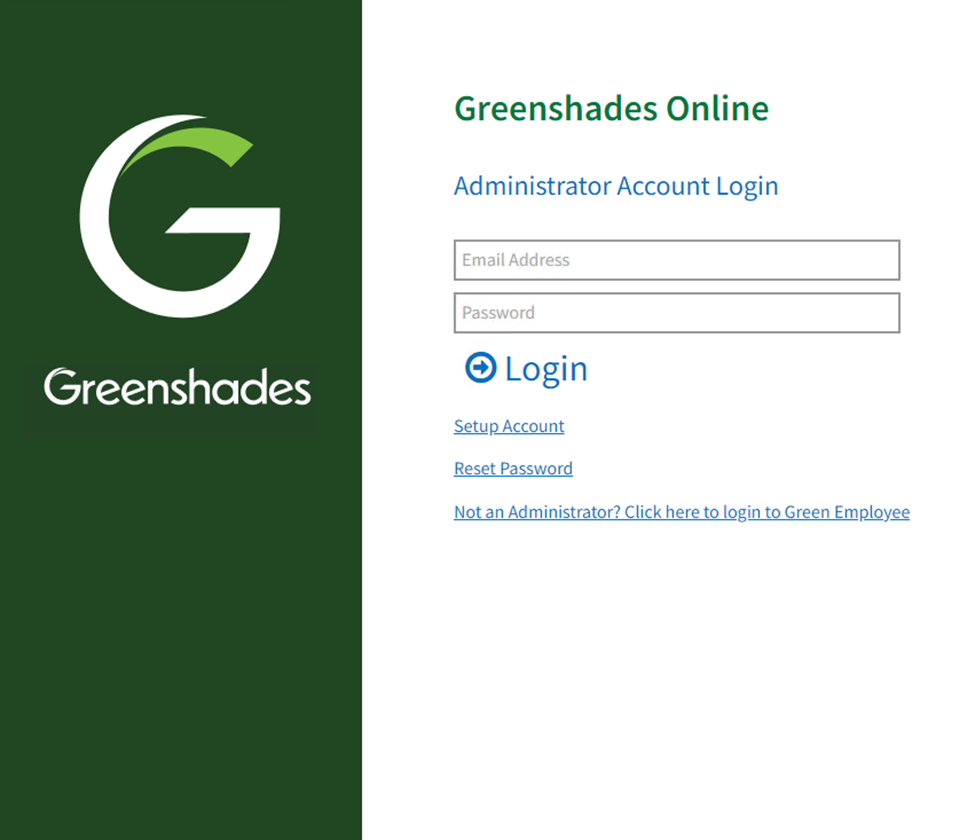

Click on the following link to the Greenshades.

Link: https://www.greenshadesonline.com/

Use your login credentials to login into the Greenshades.

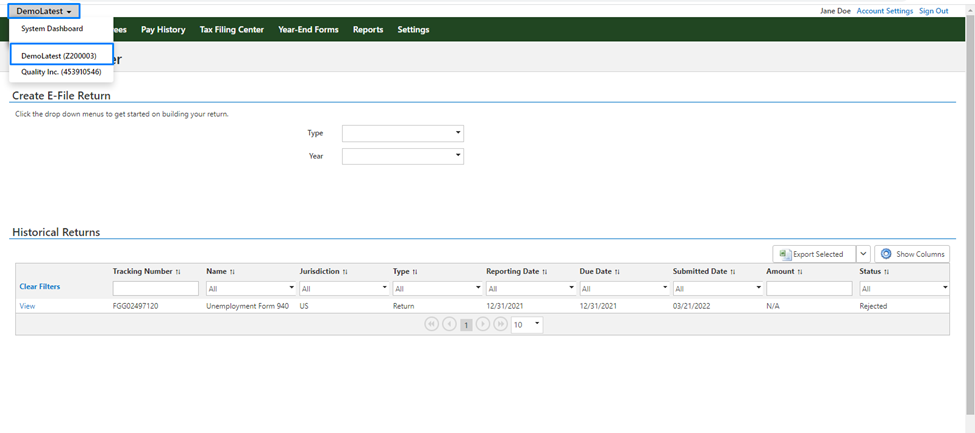

You will be redirected to the following screen. Select the company that requires Quarter End Filing.

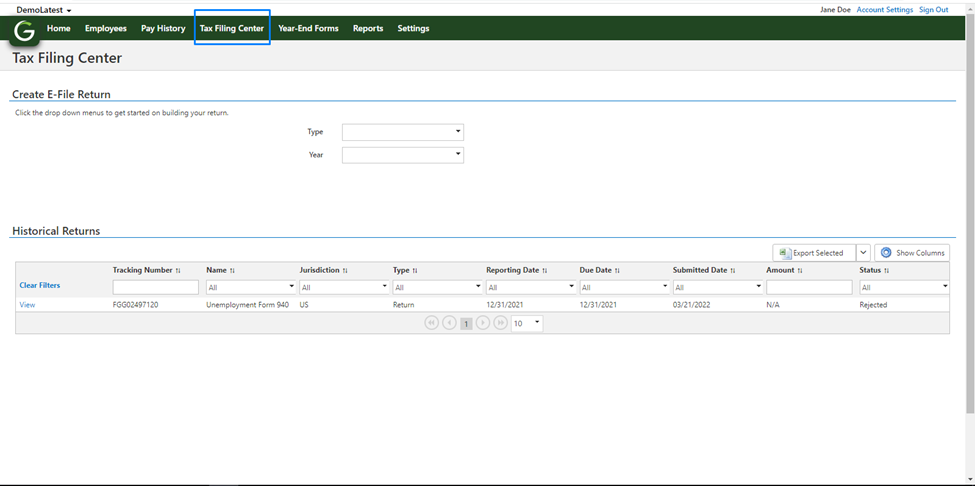

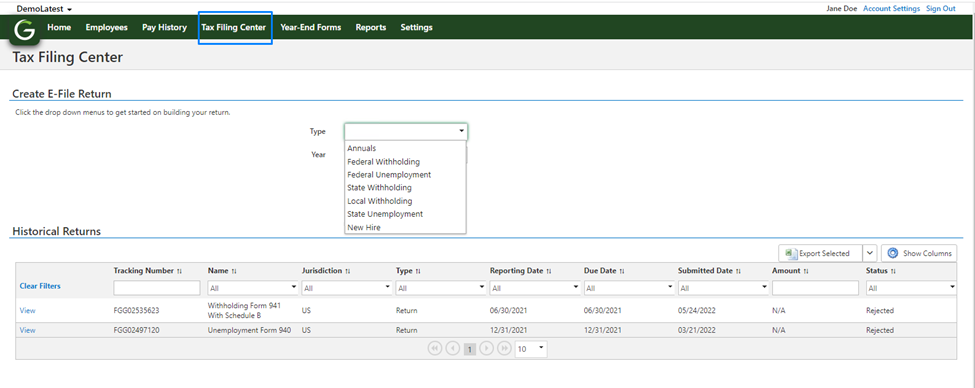

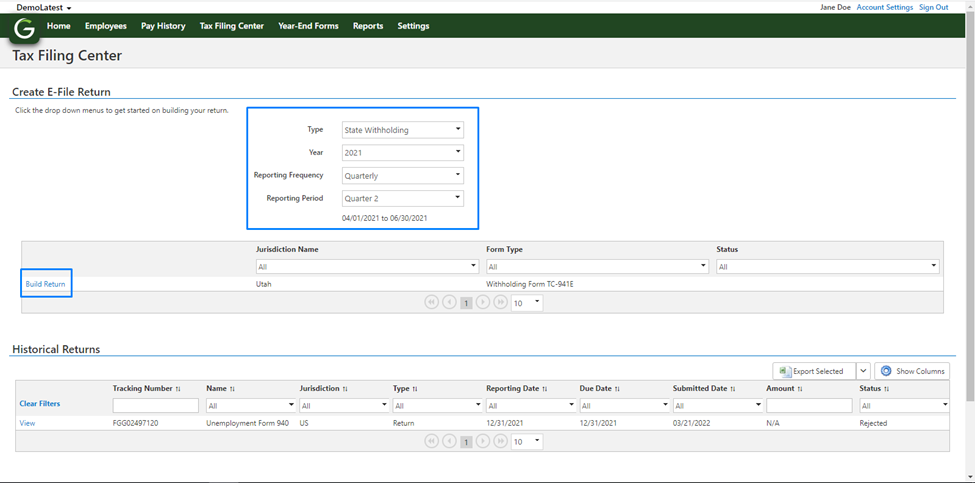

Click on the ‘Tax Filing Center’ on the top of the screen.

You will be able to process the following filings for the Quarter End Filing.

1. Federal Withholding

2. State Unemployment

3. State Withholding

4. Local Withholding

Federal Withholding

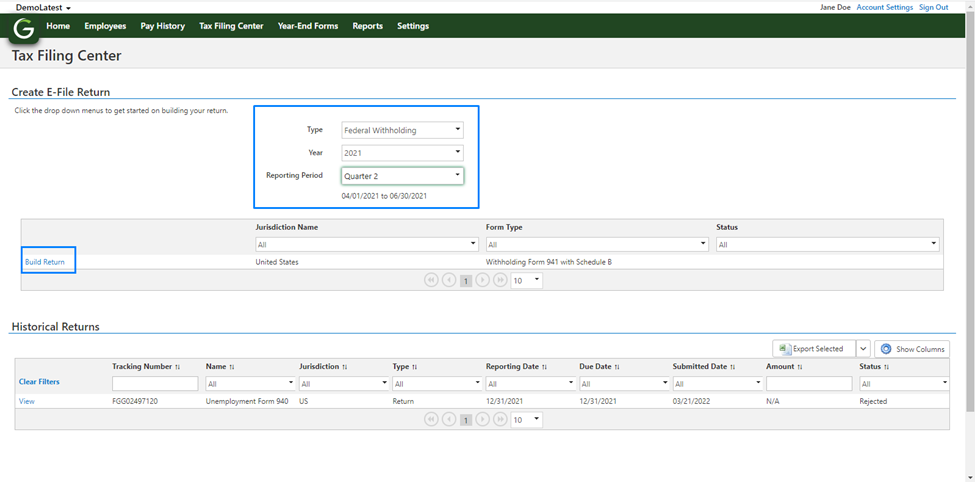

1. Select the ‘Type’ of filing as ‘Federal Withholding’ from the dropdown

2. Select ‘Year’ and ‘Reporting Period’ from the dropdown

3. Click on ‘Build Return’

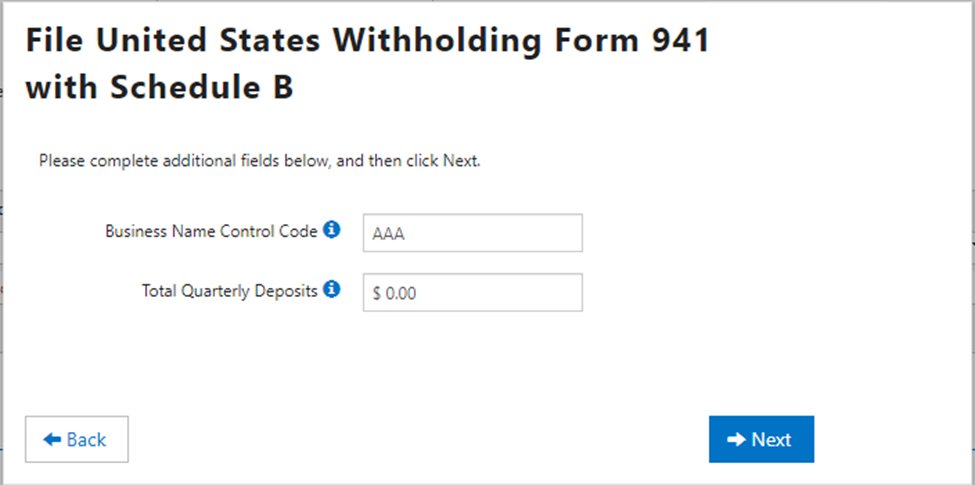

4. Enter the following details and click ‘Next.’

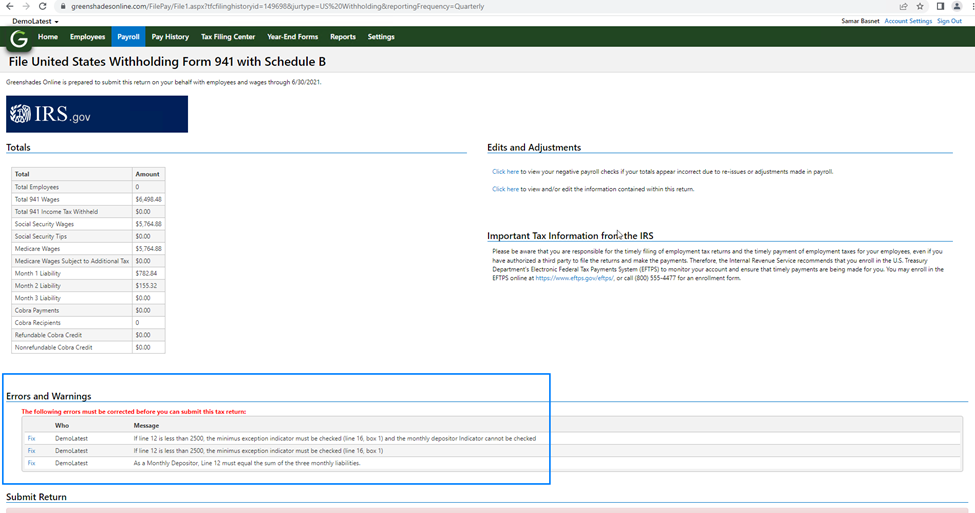

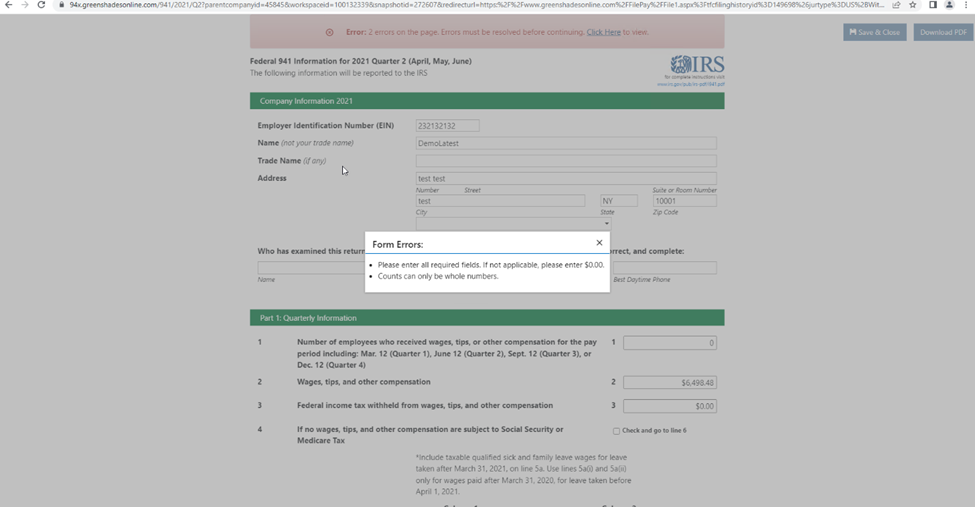

5. You will be directed to the following screen and will be asked to fix errors if any.

Click ‘Fix’ to make corrections. If the mandatory fields aren’t applicable then enter $0.00.

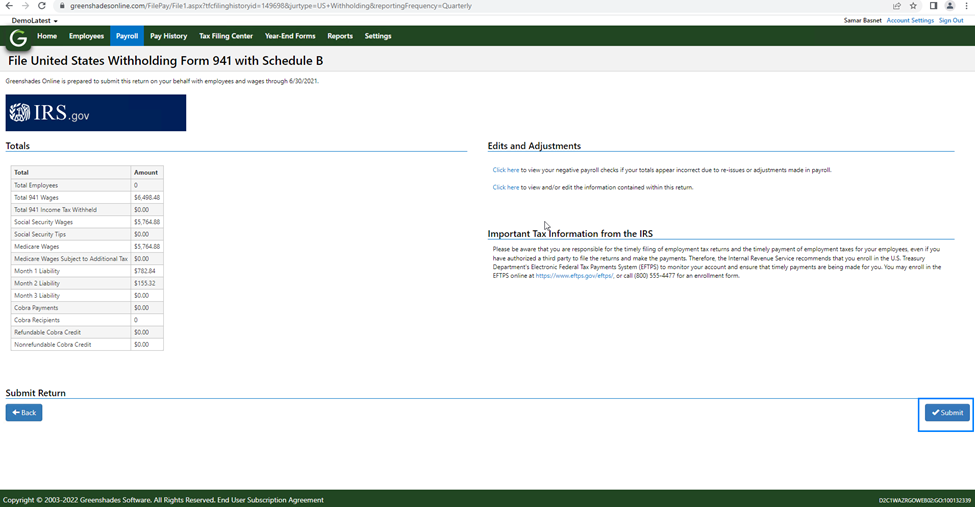

After fixing the error, you will be redirected to the following screen.

6. Complete the process of filing Federal Withholding by clicking on Submit.

State Unemployment

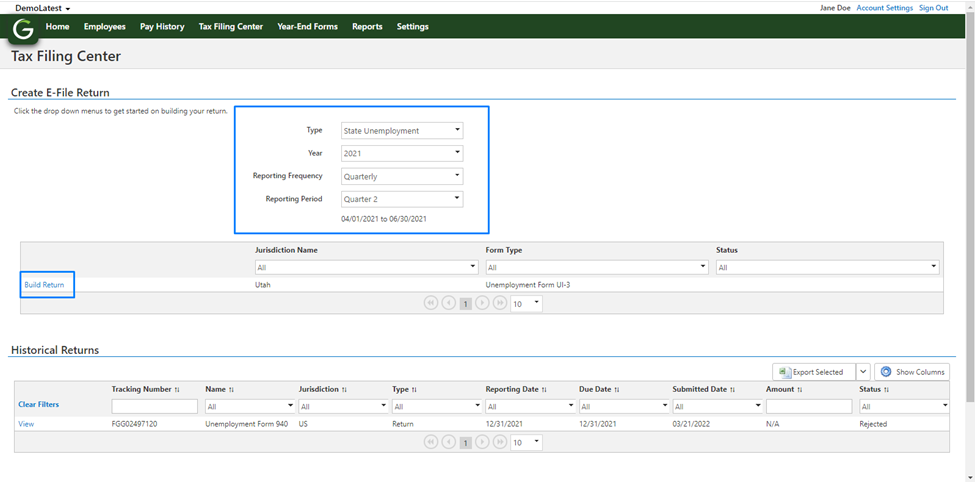

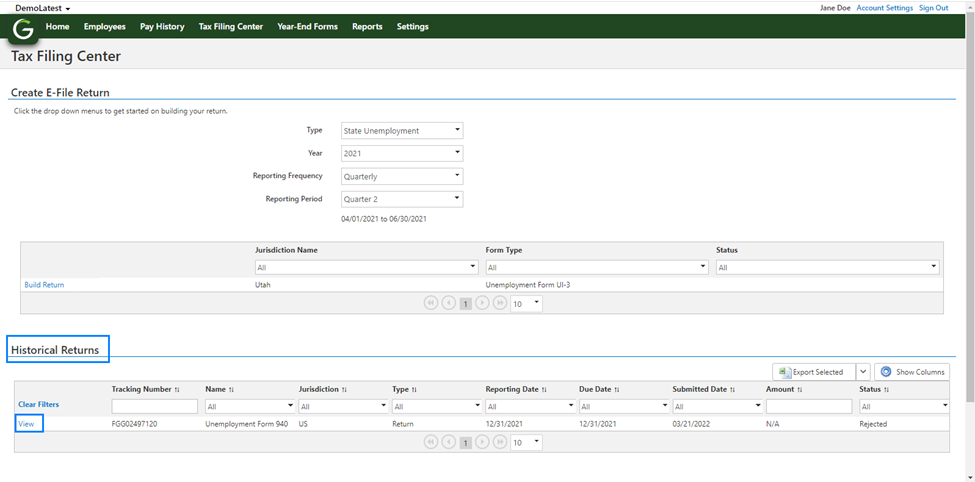

1. Select the ‘Type’ of filing as State Unemployment

2. Select the ‘Year’

3. Select the ‘Reporting Frequency’ and ‘Reporting Period’

4. Click on ‘Build Return’

You will notice ‘Historical Return’ at the bottom of the page as shown below. If you want to see the State Unemployment filled in the past then click on ‘View.’

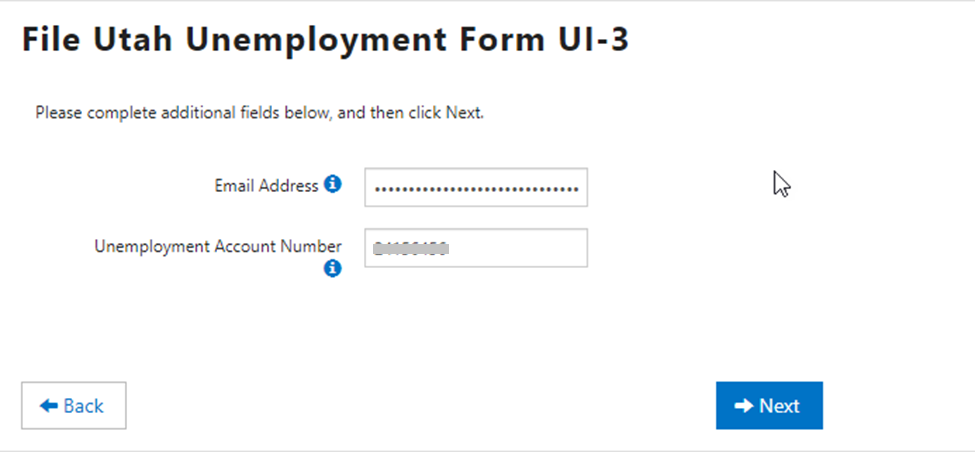

5. Check if your email address and Unemployment Account Number are correct before clicking Next.

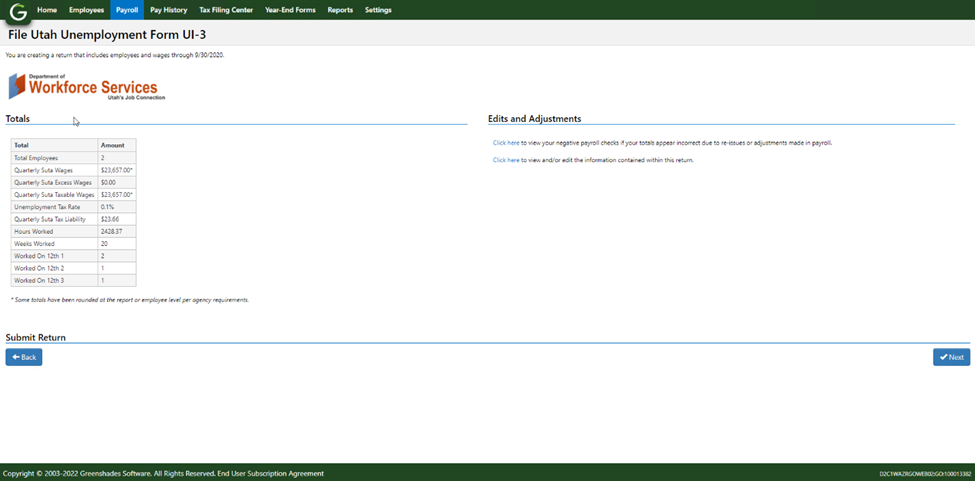

You will be directed to the following page and click on Next to complete the filing process.

State Withholding

1. Select the ‘Type’ of filing as State Withholding

2. Select the ‘Year’

3. Select the ‘Reporting Frequency’ and ‘Reporting Period’

4. Click on ‘Build Return’

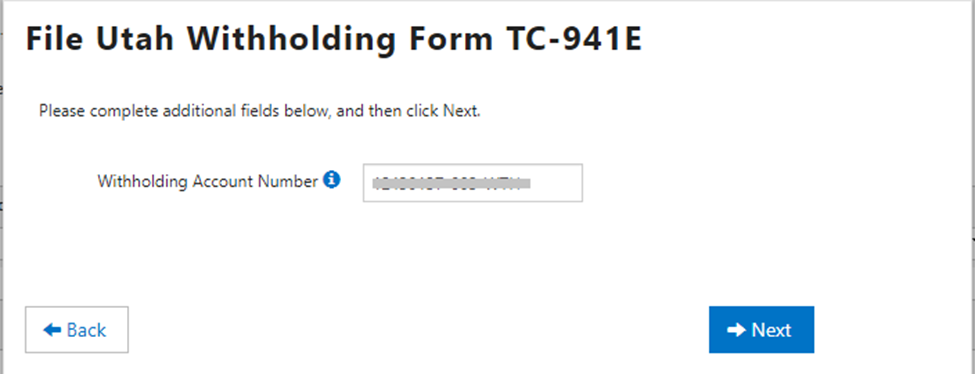

5. Check if your Withholding Account Number is correct or not before clicking Next.

The further process is similar to State Unemployment.

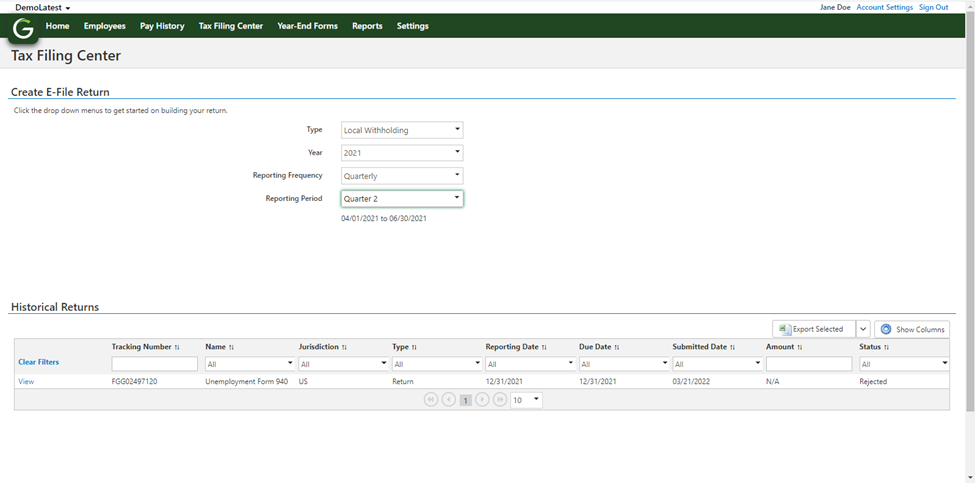

Local Withholding

1. Select the ‘Type’ of filing as Local Withholding

2. Select the ‘Year’

3. Select the ‘Reporting Frequency’ and ‘Reporting Period’

4. Click on ‘Build Return’

You will notice ‘Historical Return’ at the bottom of the page as shown above. If you want to see the Local Withholdings filled in the past then click on ‘View.’

The further process is similar to State Unemployment.